What are the Basic Financial Reporting Standards?

Financial reporting standards are essential frameworks that guide businesses in preparing and presenting their financial statements. These standards ensure consistency, transparency, and comparability across industries, enabling stakeholders to make informed decisions. This article provides a comprehensive overview of the basic financial reporting standards, key principles, and their impact on businesses.

Overview of Major Financial Reporting Standards

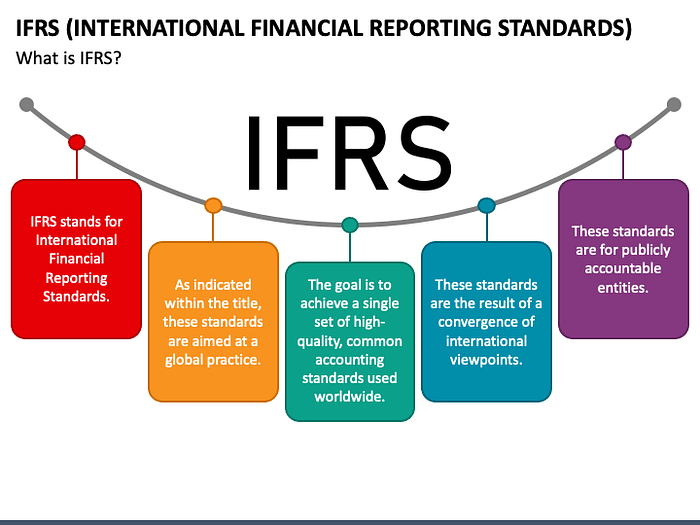

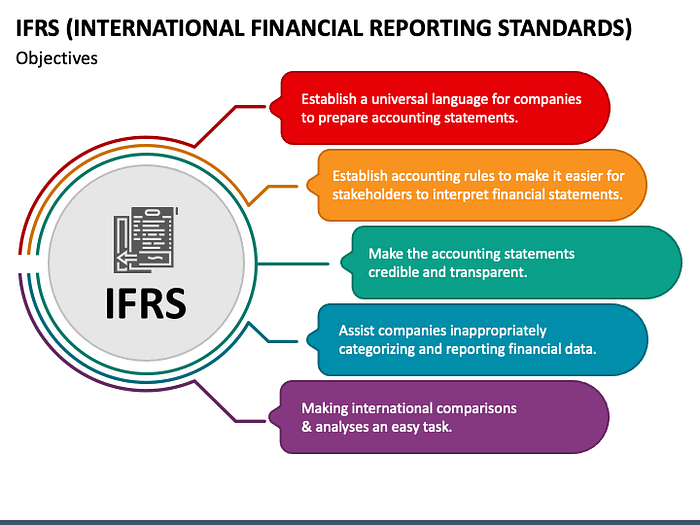

International Financial Reporting Standards (IFRS)

The IFRS is a globally recognized standard set by the International Accounting Standards Board (IASB). It focuses on providing a universal language for businesses to report their financial performance and position.

Generally Accepted Accounting Principles (GAAP)

GAAP is predominantly used in the United States and is governed by the Financial Accounting Standards Board (FASB). Unlike IFRS, GAAP emphasizes a rules-based approach to financial reporting.

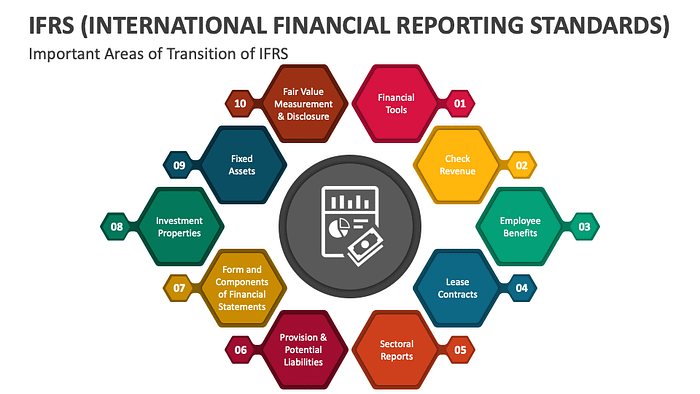

Amendments to Five International Financial Reporting Standards

IFRS 9: Financial Instruments

The amendments to IFRS 9 focus on hedge accounting and the classification and measurement of financial instruments. These changes are designed to better reflect the risk management practices of companies and improve the relevance of financial information.

IFRS 15: Revenue from Contracts with Customers

IFRS 15 was amended to clarify the principles of revenue recognition, particularly for complex contracts. These amendments help ensure that revenue is recognized consistently across industries.

IFRS 16: Leases

IFRS 16 amendments address the accounting treatment for lease modifications, specifically focusing on the presentation and disclosure requirements for lessees and lessors.

IFRS 17: Insurance Contracts

IFRS 17 brings significant changes to insurance contract accounting, with amendments aimed at enhancing comparability between insurance companies by requiring consistent measurement models.

IFRS 10 and IAS 28: Sale or Contribution of Assets

The amendments to IFRS 10 and IAS 28 clarify the accounting treatment for the sale or contribution of assets between an investor and its associate or joint venture, ensuring consistent application of the standards.

Financial Reporting: Why We Need Financial Statements

Importance of Financial Statements

Financial statements are crucial for businesses, investors, and regulators. They provide a snapshot of a company’s financial health, helping stakeholders assess performance, make informed decisions, and ensure accountability.

How They Influence Business Decisions

Accurate financial statements guide business decisions, from investment opportunities to operational changes. They allow management to make data-driven choices that align with the company’s strategic goals.

Understanding International Accounting Standards (IAS)

What is IAS?

International Accounting Standards (IAS) are older accounting standards that were replaced by IFRS. However, some IAS standards are still in effect, and they serve as the foundation for many IFRS guidelines.

Transition to IFRS

The transition from IAS to IFRS marked a shift towards a more principles-based approach, offering greater flexibility and a focus on transparency.

Key IAS Standards

Some key IAS standards still in use include IAS 1 (Presentation of Financial Statements) and IAS 7 (Statement of Cash Flows), both of which remain integral to financial reporting.

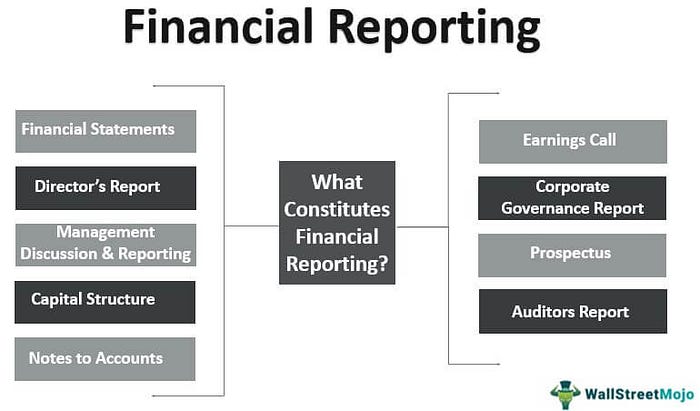

What are the 4 Types of Financial Reporting?

Income Statement

The income statement, also known as the profit and loss statement, summarizes a company’s revenues and expenses, showing net profit or loss over a specific period.

Balance Sheet

The balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a particular point in time, offering insight into its financial position.

Cash Flow Statement

The cash flow statement tracks the inflow and outflow of cash, highlighting the company’s liquidity and its ability to meet short-term obligations.

Statement of Changes in Equity

This statement outlines changes in a company’s equity during a reporting period, including profits retained in the business or distributed as dividends.

What are the Standard Financial Reports?

Purpose of Financial Reports

Standard financial reports serve the purpose of providing stakeholders with accurate, comparable information about a company’s financial health and performance.

Common Standard Reports

The most common standard financial reports include the income statement, balance sheet, cash flow statement, and statement of changes in equity. These reports are essential for evaluating a company’s profitability, liquidity, and overall financial position.

What are 5 Accounting Standards?

IAS 1: Presentation of Financial Statements

IAS 1 sets out the overall requirements for the presentation of financial statements, ensuring consistency and transparency in financial reporting.

IAS 2: Inventories

IAS 2 provides guidance on the accounting treatment of inventories, ensuring that they are valued at the lower of cost or net realizable value.

IAS 7: Statement of Cash Flows

IAS 7 requires companies to present a cash flow statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents.

IAS 8: Accounting Policies

IAS 8 addresses the selection and application of accounting policies, as well as changes in accounting estimates and errors.

IAS 16: Property, Plant, and Equipment

IAS 16 provides guidelines on the recognition and measurement of property, plant, and equipment, ensuring these assets are recorded at cost and depreciated over their useful lives.

What is Double Materiality and Why is it Important?

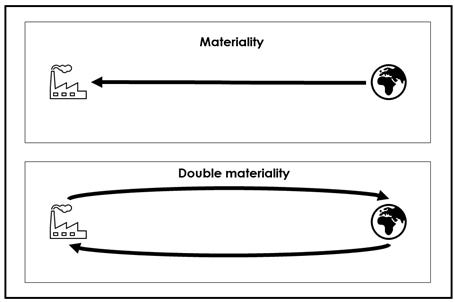

Definition of Double Materiality

Double materiality is a concept that expands the traditional definition of materiality to include both financial and non-financial information that can impact stakeholders. This is particularly important in the context of environmental, social, and governance (ESG) reporting.

Importance in Sustainability Reporting

Double materiality ensures that companies report not only on financial matters but also on issues that affect society and the environment. This approach is becoming increasingly important as stakeholders demand more comprehensive and transparent reporting on sustainability issues.

Key Concepts in Financial Reporting

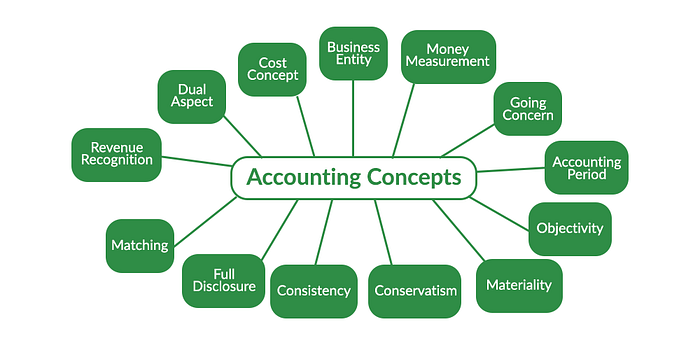

Accrual Accounting

Accrual accounting records revenues and expenses when they are earned or incurred, regardless of when cash transactions occur. This method provides a more accurate picture of a company’s financial performance.

Going Concern

The going concern principle assumes that a company will continue its operations in the foreseeable future, and financial statements are prepared with this assumption in mind.

Materiality

Materiality refers to the significance of financial information in influencing the decisions of users. Information is considered material if its omission or misstatement could affect the economic decisions of stakeholders.

The Role of Regulatory Bodies

International Accounting Standards Board (IASB)

The IASB is responsible for developing and promoting the use of IFRS standards globally. It plays a critical role in ensuring that financial reporting standards are consistent across borders.

Financial Accounting Standards Board (FASB)

The FASB governs GAAP in the United States, ensuring that financial statements are prepared according to established rules and guidelines.

Key Principles of IFRS

Principles-Based Approach

IFRS adopts a principles-based approach, allowing for greater flexibility and judgment in the application of standards. This approach is designed to reflect the economic reality of transactions.

Importance of Transparency and Comparability

One of the key principles of IFRS is the emphasis on transparency and comparability, ensuring that financial statements are clear and consistent across different jurisdictions.

Key Principles of GAAP

Rules-Based Approach

GAAP follows a rules-based approach, with detailed guidelines and specific requirements for financial reporting. This ensures consistency and reduces ambiguity.

Focus on Consistency and Reliability

GAAP’s focus on consistency and reliability ensures that financial statements are prepared in a manner that stakeholders can trust and rely on for decision-making.

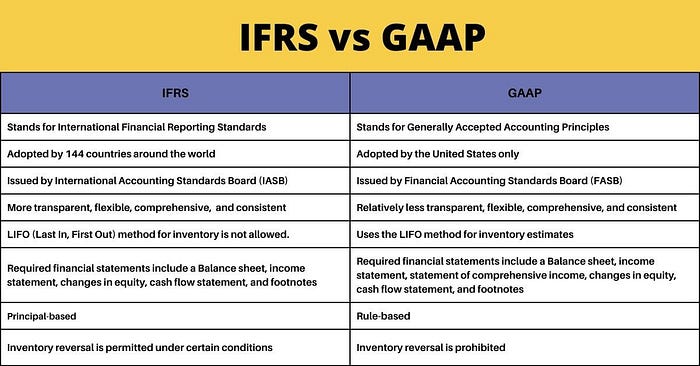

Major Differences Between IFRS and GAAP

Conceptual Differences

IFRS and GAAP differ in their conceptual approaches, with IFRS being more flexible and principle-based, while GAAP is more rigid and rules-based.

Practical Differences

Practical differences between IFRS and GAAP include the treatment of inventory, revenue recognition, and the presentation of financial statements. These differences can affect a company’s financial results and the comparability of financial statements between countries.

Accounting Services Slovenia: Elevate Your Business with MyGlobal.si Accounting Services

At My Global, we go beyond traditional accounting — we become your trusted partners in navigating the complexities of business. Our mission is to empower your company with precise, flexible, and expert accounting services that streamline your operations and support your long-term growth.

Comprehensive Accounting Solutions Tailored to Your Needs

From maintaining essential financial records to providing in-depth tax advisory services, our experienced team ensures that your accounting processes run smoothly and in full compliance with the latest regulations. We handle everything, including:

- Basic Accounting Management: Keep your financial records organized with our services, including the maintenance of the general ledger, journals, and more.

- VAT Calculation: Let us simplify your VAT obligations, ensuring accurate and timely reporting.

- Payroll Services: We handle salary calculations, contributions, and tax reporting, ensuring your employees are paid on time and in full compliance with legal requirements.

- Financial Reporting: From interim to final balance sheets, income statements, and tax calculations, we provide accurate financial insights that drive better business decisions.

- Tax and Accounting Advisory: Our team offers personalized advice to help you optimize your tax strategy and streamline your accounting practices.

Personalized Service for Every Client

At My Global, we value a personal approach. Our experts work closely with you to understand your unique needs and provide customized solutions that best fit your business model. We advocate for your interests and represent you with dedication, ensuring that your business thrives in a competitive environment.

Why Choose MyGlobal.si?

- Precision and Expertise: We ensure accuracy in every aspect of your accounting and compliance, giving you peace of mind.

- Flexibility: Our services are tailored to your needs, providing the support you need to grow and succeed.

- Dedication: We take on your administrative burdens, freeing you to focus on what matters most — your business.

Let My Global be your accounting partner, helping you navigate financial complexities with confidence. Get in touch with us today to learn more about how we can support your business success.

Contact Us

- Email: office@myglobal.si

- Phone: +386 71 543 171, +386 70 556 178

- WhatsApp and Viber: +386 71 543 171

Elevate Your Accounting Standards: Inquire About Our Services Today!

Importance of Transparency in Financial Reporting

Why Transparency Matters

Transparency in financial reporting is crucial for maintaining investor confidence and ensuring that stakeholders have a clear understanding of a company’s financial position. Lack of transparency can lead to misinterpretation and potential financial mismanagement.

Case Studies on Transparency Issues

Several high-profile cases, such as the Enron scandal, highlight the importance of transparency in financial reporting and the consequences of failing to adhere to transparent practices.

Challenges in Adopting Financial Reporting Standards

Cultural and Economic Differences

One of the challenges in adopting financial reporting standards globally is the variation in cultural and economic practices. Different countries may have unique approaches to accounting, making it difficult to achieve full standardization.

Technological Barriers

The adoption of new technologies in financial reporting can also present challenges, particularly for smaller businesses that may lack the resources to implement advanced accounting systems.

The Impact of Financial Reporting Standards on Businesses

How Standards Affect Financial Statements

Financial reporting standards directly impact how businesses prepare their financial statements. Compliance with these standards ensures that financial information is accurate, consistent, and reliable.

Impact on Decision-Making Processes

Accurate and consistent financial reporting enables businesses to make informed decisions about investments, operations, and future growth. It also provides transparency for investors and regulators.

Future Developments in Financial Reporting Standards

Trends in Global Standardization

As the global economy becomes more interconnected, there is a growing push for the standardization of financial reporting across borders. Future developments in financial reporting standards will likely focus on harmonizing IFRS and GAAP to create a more unified global framework.

Role of Technology in Shaping Future Standards

Technology is playing an increasingly important role in financial reporting, with advancements in artificial intelligence, blockchain, and data analytics shaping the future of accounting and auditing practices.

Expert Insights on Financial Reporting Standards

Quotes from Financial Experts

Financial experts emphasize the importance of adhering to financial reporting standards to maintain transparency and trust. For example, Warren Buffett has often highlighted the role of accurate financial reporting in ensuring the integrity of financial markets.

Insights from Industry Leaders

Industry leaders stress the need for businesses to stay updated on changes in financial reporting standards and to invest in training and technology to ensure compliance.

Practical Applications of Financial Reporting Standards

How Businesses Can Implement These Standards

Businesses can implement financial reporting standards by adopting robust accounting systems, staying informed about changes in regulations, and seeking guidance from professional accountants and auditors.

Examples of Successful Implementation

Many multinational corporations have successfully implemented IFRS standards, enabling them to report their financial performance consistently across different jurisdictions. For example, companies like Nestlé and Unilever adhere to IFRS, ensuring transparency and comparability in their financial statements.

Common Misconceptions About Financial Reporting Standards

Debunking Myths and Misconceptions

There are several misconceptions about financial reporting standards, such as the belief that they are only relevant to large corporations. In reality, these standards are crucial for businesses of all sizes, ensuring that financial information is accurate and reliable.

Clarifying Common Misunderstandings

Another common misunderstanding is that financial reporting standards are static and unchanging. In fact, these standards are continually evolving to keep pace with changes in the global economy and advancements in technology.

Frequently Asked Questions (FAQs)

What are the most important financial reporting standards?

The most important financial reporting standards include IFRS and GAAP, which provide the framework for preparing financial statements in a consistent and transparent manner.

How do financial reporting standards affect investors?

Financial reporting standards ensure that investors have access to accurate and comparable financial information, allowing them to make informed investment decisions.

How can businesses ensure compliance with financial reporting standards?

Businesses can ensure compliance by staying updated on changes to standards, investing in accounting software, and seeking guidance from professional accountants and auditors.

What are the most important financial reporting standards?

The most important financial reporting standards include IFRS and GAAP, which provide the framework for preparing financial statements consistently across different industries and regions.

How do financial reporting standards affect investors?

Financial reporting standards ensure that investors receive accurate and comparable financial information, enabling them to make informed investment decisions.

How can businesses ensure compliance with financial reporting standards?

Businesses can ensure compliance by staying informed about changes in regulations, investing in training, and working with qualified accounting professionals.

Conclusion

In summary, financial reporting standards play a critical role in ensuring the accuracy, transparency, and comparability of financial statements. Adopting and adhering to these standards not only helps businesses comply with regulatory requirements but also fosters trust and confidence among investors and other stakeholders. As financial reporting standards continue to evolve, businesses must stay informed and proactive in their approach to financial reporting.

.jpg)

Comments

Post a Comment